When it comes to leasing, we have already tracked our sales and have discovered that there occurs a fascinating trend. About 92% of the total number of leased equipment includes the utilization of a third-party supplier. Out of the 92%, we have seen 89 % of the leases being written under the 60-month term.

60 months equates to five years, which is actually a long period of time for a lease, and with faster innovation changes these days, why would somebody pick a 60-month lease over a 24-month or 36-month term?

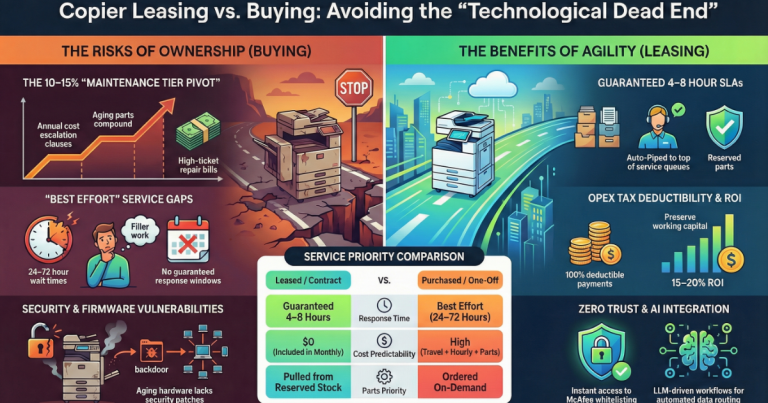

Short-term leases included the benefit of faster upgrades, and after a period of 24 months, for instance, of having a leased photocopy machine, the technology could have modified a lot. If you sign in for a 60 month lease, you will for sure experience costly product break downs, and your dependable repair service specialist could be replaced with another technician. Short-term leases, to many, lower these risks.

However, a key factor why clients sign in for a 60-month lease term is the fact that it gives them the ability to use the photocopy machine at a much lower cost. When the lease term ends, they will just deliver the copy machine back to the renting business. Aside from this, lessees are required to send a notice of cancellation, which is mostly 90 to 180 days beforehand, so as to notify the lessor on whether they will get another contract or not. Companies do not have the time to stress over these things, which is why they typically select the 60-month lease because it means they have to do it less often.

So, before you go about leasing or purchasing your next copy machine, you will have to understand that there are tax ramifications.

Under the tax code, leases have been categorized under business expenses. A purchase, however, is treated as a capital outlay. If you think that a purchase is more ideal for your business, 40 % of the copier’s total purchase cost could be deducted in the very first year. Up until you have paid back the loan, you could deduct 25% of the overall cost each year.

Each state may have different tax rules, so please consult your accountant to be sure of the matter. After you have paid the loan, the copy machine is all yours. Leasing a copy machine does cost more over the course of time, but numerous companies opt to lease because the expenditure is 100% deductible. If you decide to lease, your company’s tax liability could be lower than if you acquired it outright. Nevertheless, you should speak with a tax professional to help you assess the special conditions of your business and the industry you are dealing with transactions with.

When the lease term ends, you could opt to return the machine or renew the contract. Whether you decide to acquire a copy machine outright or lease it instead, Copier Leasing Dallas and Copier Leasing Fort Worth TX can make recommendations on what will best fit your management tasks and spending plan. Are you looking for a competitive quote on leasing? Contact us through (469) 208-9300 and we will help you get the most value at the best price.